Hyperliquid at a glance

The goal is to combine on-chain transparency with CEX-level controls: a familiar order book, native order types, real-time settlement, and no custody risk. You connect a wallet, sign transactions, and trade under self-custody.

How it works

Trading-first Layer-1

Hyperliquid is its own Layer-1 optimized for low-latency order events and fast finality. The design favors deterministic settlement and easy composition with vaults, analytics, and strategy modules built on top.

On-chain CLOB instead of AMMs

Instead of automated market makers, Hyperliquid runs a decentralized order book. This enables:

- price-time priority and predictable execution;

- native limit, market, and stop orders;

- lower slippage when depth is sufficient.

Self-custody accounts

Funds remain in your wallet. Every action is a signed transaction. Lost seed = lost access, so key hygiene is non-negotiable (see security tips below).

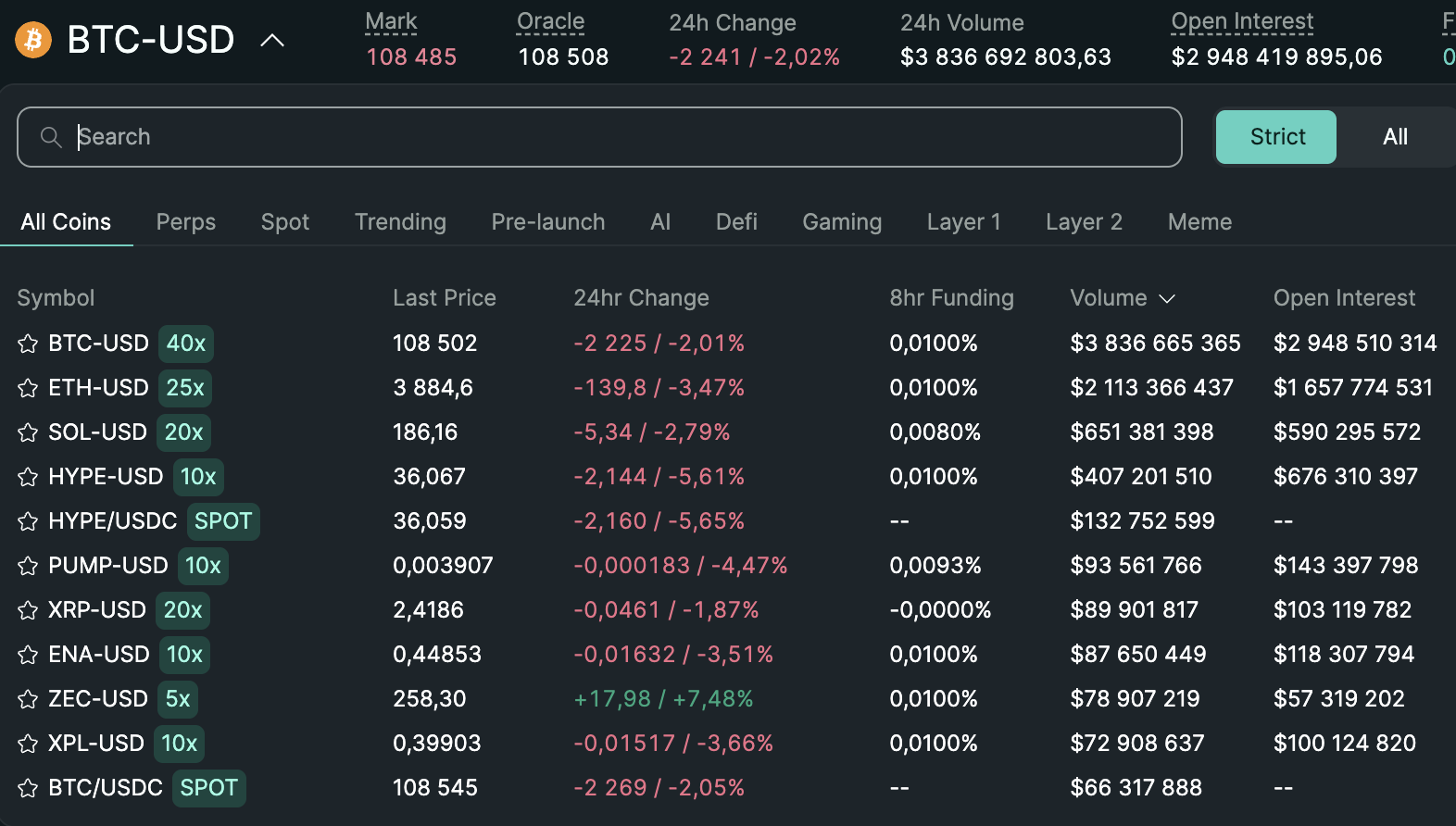

What you can trade

Spot markets

Direct asset exchange with limit bids/asks, order-book depth, and granular control over entries and exits. Spreads typically tighten as liquidity grows.

Perpetual futures

On-chain perps with leverage, cross/isolated margin, stop-loss and take-profit. Funding payments help the perp price track spot over time.

Liquidations and insurance

Positions can be liquidated when equity falls below maintenance margin. Protocol insurance funds absorb bankruptcies; their state is visible on-chain.

Fees, funding, and execution

Trading and network fees

Expect a maker/taker schedule plus network fees for transactions. During volatile periods, all-in costs rise due to wider spreads and increased on-chain activity.

Funding rates

Perp funding periodically transfers between longs and shorts to align the perp with spot. Track funding alongside your PnL, especially if you hold positions across funding flips.

Execution quality

Execution depends on depth, latency, and slippage. In thinner books, prefer limit orders and split size into tranches. During high liquidity, aggressive orders are feasible, but stops remain critical.

Getting started: step-by-step

- Set up a wallet. Use a self-custody wallet that supports the Hyperliquid network. Store your seed phrase offline.

- Bridge or deposit assets. Move supported assets onto the chain. First transfer should be a small “dry-run.”

- Connect and review permissions. Check the URL, verify what you sign, and only approve what you understand.

- Pick a market. Start with spot if you are new to leverage. For perps, configure margin mode and risk limits upfront.

- Place orders. Prefer

limit/stopwith pre-set TP/SL. Avoid market orders in thin conditions. - Manage risk. Use isolated margin for new strategies, keep collateral buffers, and set alerts.

- Withdraw idle funds. Keep only active capital in your hot wallet; move the rest to long-term custody.

Security: protocol and user responsibilities

Protocol side

Audited contracts, robust consensus, and on-chain transparency for insurance funds, liquidation flows, and core metrics help the community monitor risk.

User side

- Use a hardware wallet for high-value accounts.

- Bookmark official domains; verify signatures before approving.

- Revoke stale approvals and rotate keys on hot wallets.

- Separate wallets for trading, savings, and testing.

Key risks and limitations

Market and liquidation risk

Leverage amplifies both profits and losses. Sudden moves can liquidate positions before you react. Conservative sizing and hard stops are essential.

Liquidity and slippage

Off-hours and news events thin depth and widen spreads. Scale entries/exits and avoid chasing moves.

Operational risk

Bridging errors, wrong networks, bad approvals, or signing the wrong transaction can cause losses. Always test with a small amount first.

Regulatory uncertainty

Rules for on-chain derivatives vary by jurisdiction and evolve. Ensure your activities are permitted where you reside.

HYPE token: quick view

Utility

HYPE is the native token linked to governance, staking, and potential value capture from protocol activity (based on current tokenomics).

Economics

Supply, emissions, vesting, treasury policy, and any fee-share/buyback define long-term incentives. Review official docs before taking exposure.

Investor checklist

- Confirm current tokenomics and treasury policies.

- Track on-chain volumes and activity as a proxy for value capture.

- Size positions for high volatility and regime shifts.

Hyperliquid vs alternatives

Against AMM DEXes

Pros: native order types, tighter spreads with depth. Trade-off: higher complexity for beginners.

Against CEXes

Pros: self-custody, on-chain transparency, no centralized withdrawal risk. Trade-off: you handle keys, gas, and bridges.

Against other on-chain perps

Pros: fully on-chain CLOB design and performance focus. Trade-off: liquidity varies by market; monitor growth metrics.

Practical tips

- Start small until you master deposits, orders, and withdrawals.

- Prefer limit/stop orders; avoid market orders in thin books.

- Segment wallets and keep collateral buffers.

- Do a monthly approval-revoke and backup audit.

Try Xgram for cross-chain

If you’re also looking for ways to exchange or trade your coins with minimal hassle, Xgram might be worth exploring. Here are five sentences on why xgram could be a smart option:

- Xgram is a versatile exchange platform that supports multiple blockchains, making cross-chain transactions more straightforward.

- You can save on fees by taking advantage of xgram’s optimized liquidity pools, which help lower the cost of swapping tokens across different networks.

- The platform’s user-friendly interface means you won’t get lost browsing through complicated menus or jumpy price charts.

- With cross-chain capability, you can easily diversify your crypto holdings in just a few clicks.

- Whether you’re a casual user or a more seasoned investor, xgram enables smooth transactions that can help you hold onto more of your gains.

FAQ

Is Hyperliquid decentralized?

Yes. Orders settle on-chain and you keep custody via your wallet.Can I use a hardware wallet?

Yes. Recommended for large balances and long-term storage.Are fees lower than CEX?

Maker/taker can be comparable, but add network fees. During peaks, total costs rise.Who should trade perps?

Experienced users. Beginners should stick to spot until comfortable with risk.Are there fiat on-ramps?

Hyperliquid is on-chain. Use external on-ramps, then bridge or deposit assets to trade.

Bottom line

Hyperliquid pairs a trading-centric Layer-1 with a decentralized order-book exchange. If you want self-custody and CEX-like control, it is one of the strongest on-chain options — provided you manage keys and risk with discipline.

This guide is educational and not investment advice. Verify live fees, supported assets, and your local rules before trading.