Understand the layer 2 concept

Layer 2 solutions are networks built on top of a base blockchain like Ethereum. They exist to lighten the load on the main chain, which often struggles with high fees and slower transaction speeds. For beginners, think of Ethereum as a busy highway during rush hour. Layer 2 is a side road designed to keep traffic flowing quickly, costing less in gas fees.

A simple statistic can show why these solutions matter: over the past few years, Ethereum has sometimes charged more than $50 in fees for a single transaction, especially during trading peaks. Imagine paying $50 for a simple DeFi swap. That is one reason demand for faster, cheaper alternatives has soared. Layer 2 solutions aim to lower fees by processing the bulk of computational work away from the main Ethereum network.

Arbitrum is a prime example of this. Instead of clogging up Ethereum’s mainnet with every tiny task, Arbitrum rolls thousands of transactions into a single batch. Then, it submits that batch (and a proof of correctness) to Ethereum. The main chain gets the essential information, but not the congestion. Users enjoy a swift, wallet-friendly experience, which is good news if you are new to decentralized finance (DeFi).

Explore Arbitrum’s key features

When you first ask yourself what is Arbitrum, you might wonder what makes it special. In essence, Arbitrum is a fast, low-cost network designed to reduce Ethereum gas fees. Let’s look at its three standout features:

Optimistic rollups

Arbitrum uses optimistic rollups, which bundle transactions off-chain and post only the final proof on Ethereum. Optimistic here means transactions are assumed valid unless proven otherwise. By keeping minimal data on-chain, Arbitrum slashes resource needs.High security anchored on Ethereum

Arbitrum is secured by Ethereum’s robust consensus. If someone ever tries to submit fraudulent data, there is a fraud-proof system ready to catch mistakes. That security, combined with the lower costs off-chain, is the reason many DeFi projects embrace Arbitrum.Developer-friendly environment

Because Arbitrum is EVM-compatible (Ethereum Virtual Machine compatible), developers can migrate their dApps from Ethereum to Arbitrum with minimal code changes. This easy integration has led many popular DeFi apps, such as lending protocols and decentralized exchanges, to launch on Arbitrum. As of a recent 2023 analysis, dozens of top-rated decentralized applications now live on Arbitrum, giving you a broad ecosystem to explore.

Here is a quick table comparing Ethereum Layer 1 to Arbitrum Layer 2 to highlight how different they can feel:

| Factor | Ethereum (Layer 1) | Arbitrum (Layer 2) |

|---|---|---|

| Transaction speed | ~14 TPS (transactions per second), | Up to thousands of TPS (theoretically 40,000). |

| Fees | Often expensive in peak times | Significantly lower on average |

| Mechanism | Proof-of-Stake (mainnet) | Optimistic rollups for off-chain batching |

TPS stands for transactions per second, and it is a shorthand for throughput. When Ethereum is overloaded, waiting times grow. Arbitrum effectively bypasses a lot of that congestion.

Weigh the benefits and challenges

Adopting a Layer 2 network can feel like a leap, but it helps to see both sides.

Lower fees

Many DeFi trades on Ethereum can cost upwards of $10 in gas. Arbitrum cuts that total by as much as 70-95%. Over time, that difference can free up budget for earning strategies.Faster transactions

Because Arbitrum processes data off-chain, it can finalize transfers more quickly. You avoid the dreaded pending status that plagues busy Ethereum days.Familiar environment

For developers and users, Arbitrum looks and feels similar to Ethereum. You can keep your usual wallet (like MetaMask) and continue using Ethereum-based apps, but at a fraction of the cost.

Still, every technology has some challenges:

Bridge delays

Moving funds between Ethereum and Arbitrum involves a “bridge,” which can take several minutes. During congestion, bridging times may rise. Some users are also cautious about bridging protocols that rely on external validators.Liquidity distribution

Because Arbitrum is still growing, certain assets or pairs may have lower liquidity than on Ethereum mainnet. This can lead to slightly less favorable trading conditions, especially for less common pairs. Thankfully, usage has grown quickly, so major tokens generally see decent liquidity.Learning curve

If you have never experimented with Layer 2 solutions, it is wise to do a few small test transactions first. A new environment means new steps, but they are usually straightforward.

See how Arbitrum works in DeFi

For a DeFi enthusiast, Arbitrum is a game-changer. Its low fees open up new ways to experiment with yield farming, token trading, and NFT marketplaces. You do not have to wait forever for confirmations or wonder if gas fees will eat up half your gains.

Some of the biggest DeFi protocols on Ethereum, such as certain lending platforms or decentralized exchanges, have hopped over to Arbitrum. That means you can supply liquidity, lend assets, or stake tokens on Arbitrum versions of your favorite dApps. You will often find the user interface nearly identical to the Ethereum mainnet version, minus the expensive transaction pop-ups.

Real-world use case examples

Yield farming

Suppose you want to deposit stablecoins into a yield aggregator. On Ethereum, a single deposit might cost $30 in gas. On Arbitrum, that same action could be just a few dollars or less.Swaps and day trading

If you frequently swap tokens, you know how gas fees add up. Arbitrum helps you swap many times a day, usually without worrying about triple-digit transaction costs.NFT minting

While less popular for NFTs than some other Layer 2s, Arbitrum still lets artists mint cheap NFTs. You can experiment with collectible launches at a lower cost.Micro-transactions

DeFi can involve sending small amounts to multiple addresses. Doing that on Ethereum can quickly burn your wallet. Arbitrum’s minimal fees make micro-transactions viable.

Good news—if you felt DeFi was too pricy or too complex, Arbitrum’s user-friendly approach and cost efficiency might change your mind.

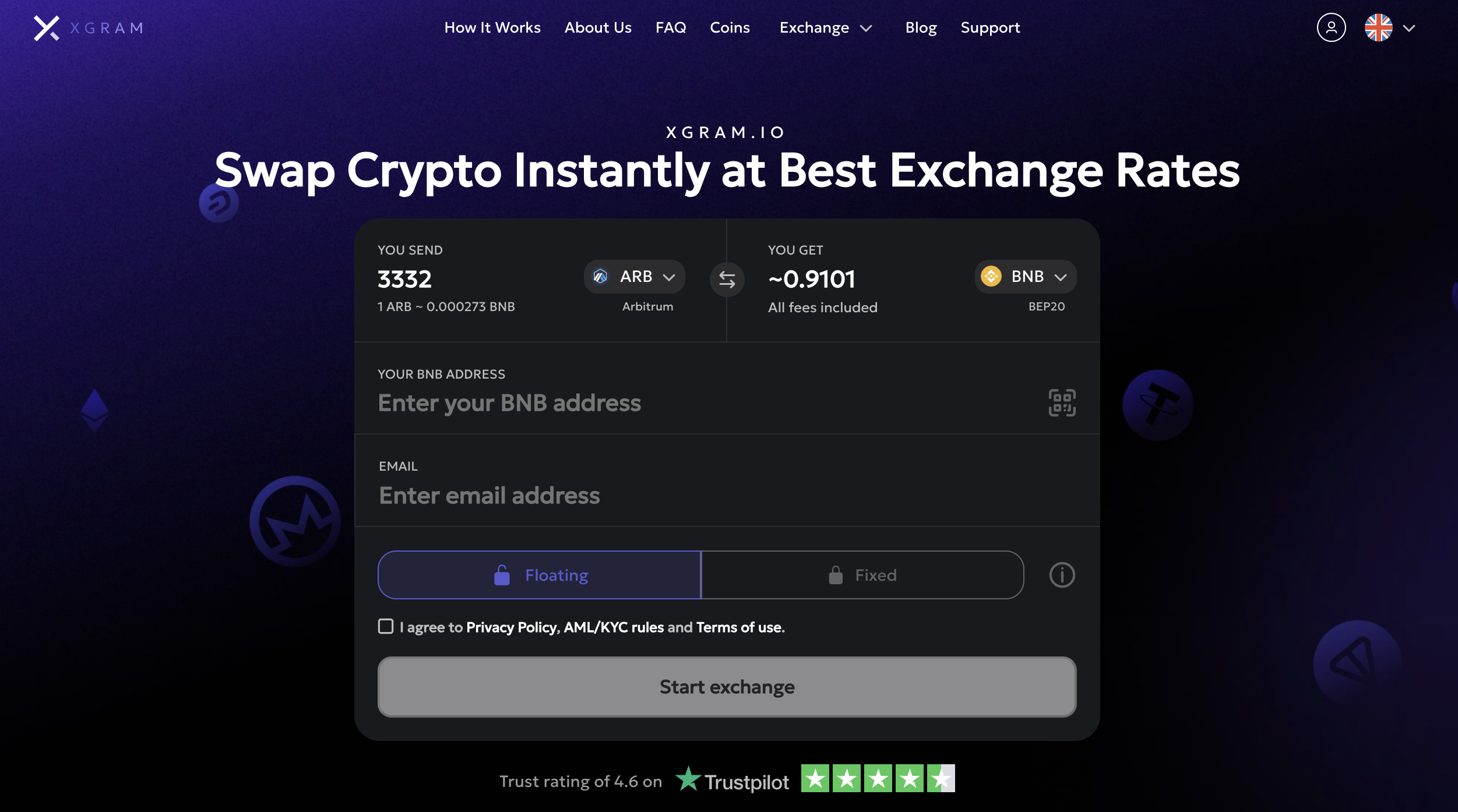

Consider Xgram for cross-chain

You might wonder how to move from one chain to another without paying outrageous fees. Cross-chain exchanges are here to help. One option to explore is xgram, which enables bridging funds between different networks. Here are five quick sentences to help you see why Xgram matters:

- Xgram is an online exchange platform designed to let you swap assets and move them across different blockchains without heavy transaction costs.

- It supports various chains, helping you jump from Ethereum to Arbitrum or other Layer 2 solutions.

- By consolidating trades into batches, xgram often lowers fees for cross-chain actions.

- Users can take advantage of its intuitive interface, which simplifies bridging steps for beginners.

- If you seek a streamlined way to manage tokens and avoid a maze of separate wallets, xgram’s cross-chain service is worth a look.

As bridging becomes more popular, we expect more exchanges like Xgram to appear. However, it is a good practice to research thoroughly, check reviews, and start with small amounts when testing any new bridge. You will want to minimize risks and confirm that your destination network supports the tokens you plan to move.

Quick recap and next steps

Arbitrum is a Layer 2 solution that can chop Ethereum fees down to size, speed up transaction confirmations, and remove many frustrations of dealing with mainnet congestion. You saw how optimistic rollups work, read about the main benefits, and learned that bridging, while slightly more complex, pays off in reduced gas costs.

If you are itching to try Arbitrum:

- Set up your wallet by adding the Arbitrum network (this typically involves configuring a custom RPC).

- Bridge a small amount of Ether (ETH) from Ethereum mainnet to Arbitrum so you have gas to spend.

- Experiment with a DeFi protocol or a quick token swap.

- Compare the fees to your past Ethereum transactions and see how it feels.

- If you need cross-chain flexibility, try an exchange like xgram to save on bridging fees.

Feel free to start small. The lower costs should make it easier to test different techniques without breaking your budget. Remember, DeFi is all about learning and adapting to new opportunities. Arbitrum might just be the stepping stone you need to unlock faster, cheaper on-chain activity.

Frequently asked questions

What is the difference between Arbitrum and Ethereum mainnet?

Arbitrum is a Layer 2 solution built on top of Ethereum. It works by grouping transactions off-chain (using optimistic rollups), then settling them on the Ethereum mainnet. That approach leads to lower fees and faster confirmations, while security remains anchored to Ethereum.Do I need a special wallet to use Arbitrum?

Generally, you can start with popular Ethereum-compatible wallets (like MetaMask). You simply add Arbitrum’s chain details to your wallet, fund the Arbitrum network with a bit of ETH for gas, and you are good to go.Are transaction fees on Arbitrum always cheaper?

Yes, fees are typically lower, often by 70-95% compared to Ethereum mainnet. However, they can vary based on network usage. In periods of extreme congestion, fees might rise slightly, though they remain much lower than mainnet fees.Can I run NFTs on Arbitrum?

Absolutely. Arbitrum can handle NFT minting, trading, and transfers. While NFTs may be more common on other Layer 2s, Arbitrum supports them, and the lower fees still apply.Should I worry about security risks?

Arbitrum inherits security from Ethereum, but every Layer 2 solution has smart-contract risks and bridging complexity. Use reputable bridges, confirm token addresses, and start with small test transactions until you feel comfortable.

With these fundamentals in mind, you should have a clear idea of how Arbitrum slots into the broader DeFi landscape. It is a welcoming place to try new strategies without burning through your funds on gas. If you are ready to explore, Arbitrum may be the key to cheaper and faster decentralized applications. Good luck, and enjoy your journey in DeFi.