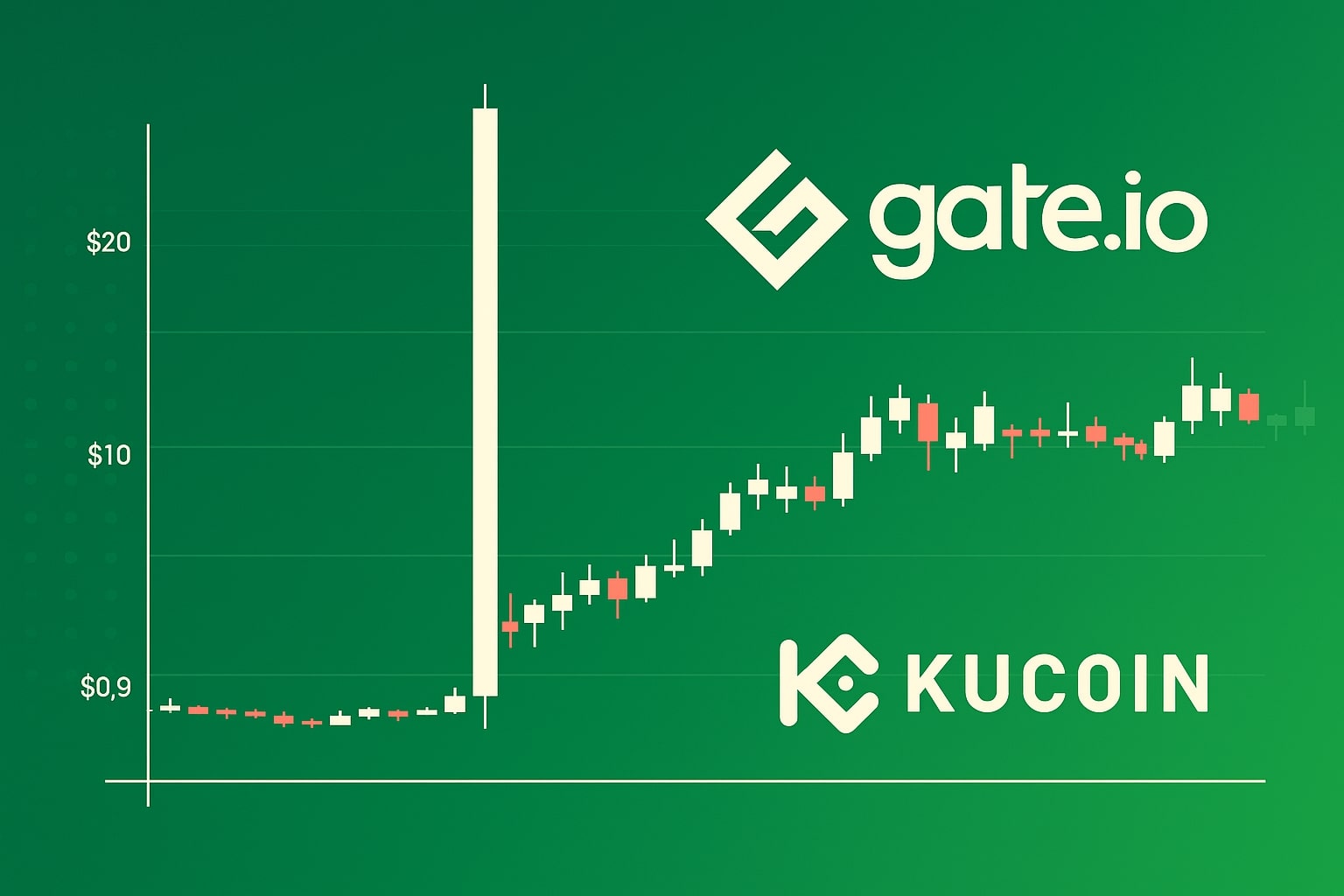

Gate Pushed the LA Futures Price to $27 and Left Traders Empty-Handed

A one-hour listing, a single $2 000 order, and a vertical candle

On the evening of 4 June Gate quietly listed a linear LA/USDT perpetual. Liquidity was paper-thin—only a few thousand dollars resting in the book. Worse, the exchange based its index almost entirely on KuCoin, where no resting orders existed at the same levels.

Forty-five minutes after launch a trader hit the KuCoin book with a single $2 000 market buy. Because there was literally nothing on the ask side, the trade printed at ever higher ticks until it topped out near $27. Gate’s index dutifully mirrored the spike; its own perp contract followed like a shadow. Short positions were wiped out before most dashboards had finished drawing the candle.

The exchange’s response

About an hour after the contract went live Gate delisted it, explaining that:

- negative balances would be forgiven out of the insurance fund;

- lost margin and missed profit would not be reimbursed because “price swings are a normal market risk.”

In plain English: liquidated traders got their debt reset to zero but none of their collateral back.

Why users are furious

- The spike happened only on Gate because the index copied a ghost print from an illiquid KuCoin pair.

- The contract was live for less than an hour—nowhere near enough time for stress testing or circuit breakers.

- Traders argue that guarding against single-trade distortions is the exchange’s job, not an act of kindness.

Gate insists the insurance pool covered its obligations, yet angry clients are drafting group complaints and threatening to move volume elsewhere.

Takeaways for anyone trading exotic futures

- Check order-book depth before opening size. A candle can go parabolic when there’s simply nothing to hit.

- Know the index components. If a perp relies on one thin venue for price feed, treat it like a loaded gun.

- Avoid high leverage on brand-new pairs. A 10× short on a day-old listing is an invitation to the liquidation engine.

- Keep margin reserves in stablecoins, so auto-top-ups have time to kick in if volatility erupts.

Bottom line

Gate erased traders’ negative balances but refused to restore their vanished margin—effectively calling the incident “just market risk.” The episode shows how a single $2 000 trade can detonate an ill-prepared index and how quickly trust evaporates when an exchange’s safeguards fail. On a 24/7 market the next surprise spike is always one thin order book away.